Moomoo in Malaysia

Home

Moomoo is an advanced trading and investment platform designed for investors of all levels. In Malaysia, the company operates under the name Moomoo Securities Malaysia Sdn. Bhd. and is regulated by the Securities Commission Malaysia (SC). The platform offers a wide range of tools and capabilities for trading Bursa Malaysia stocks, ETFs, REITs, and warrants, as well as U.S. and Singapore stocks.

Key Advantages

- Single account for trading across multiple markets

- Free real-time Level 1 quotes for Malaysia

- Competitive trading fees with zero commission for the first 180 days

- Advanced analytical tools and charting

- Educational resources and an interactive community

- 24/5 customer support via phone, live chat, and email

- Shariah-compliant stock filter for Muslim investors

- Margin trading with competitive 6.8% annual interest rate

- No minimum deposit required to open account

- Desktop platform with multi-monitor support and advanced order types

Available Markets and Assets

Moomoo provides access to trade the following assets:

- Bursa Malaysia stocks, ETFs, REITs, and warrants

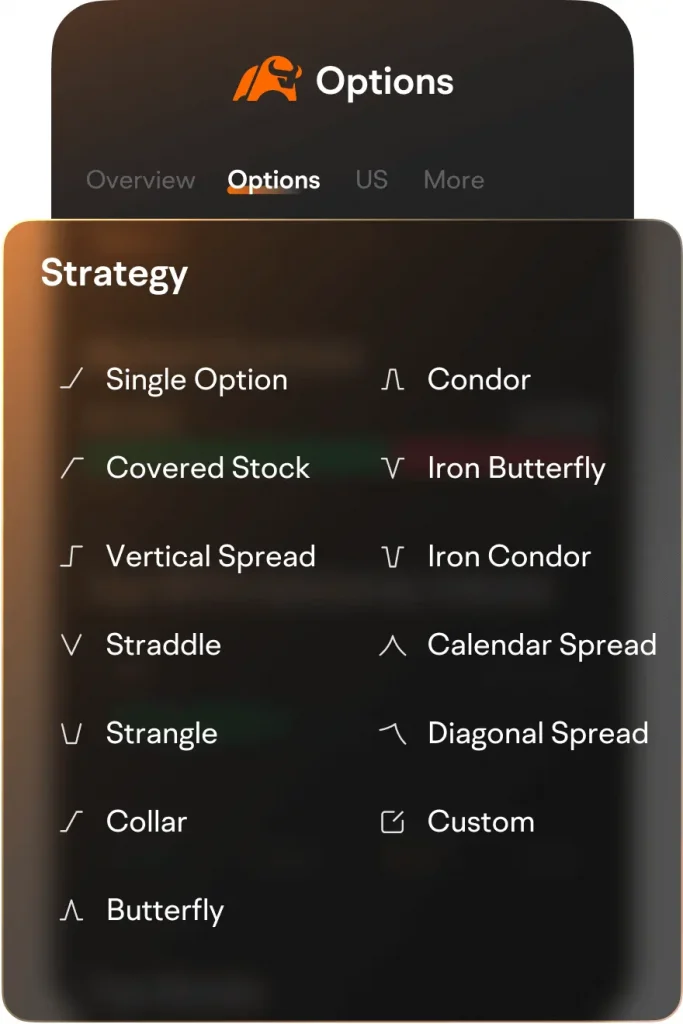

- U.S. stocks, ETFs, and options

- Singapore stocks and ETFs

- Hong Kong stocks

- Chinese A-shares

With one universal Moomoo account, investors can conveniently access and trade securities across these global markets from a single integrated platform.

Commissions and Fees

Below is a table outlining the commissions and fees for trading various markets through Moomoo Malaysia:| Market | Commission | Order Fee | Other Fees |

| Malaysia | 0%* | RM3 per trade | Clearing fee 0.03%, stamp duty |

| U.S. | 0%* | $0.99 per trade | SEC, FINRA fees |

| Singapore | 0%* | 0.05% of trade value, min. $5 | Stamp duty |

| Hong Kong | 0%* | HK$15 per trade | Transaction levy, trading fee |

| China A-Shares | 0%* | CNY15 per trade | Handling fee, stamp duty |

- Account maintenance fee: None

- Minimum deposit: RM0

- Wire transfer fees: Free for incoming, RM10 for outgoing domestic

- Stock transfer fees: RM75 per transfer out

- Margin interest rate: 6.8% per annum

- Corporate action fees: No processing fees charged

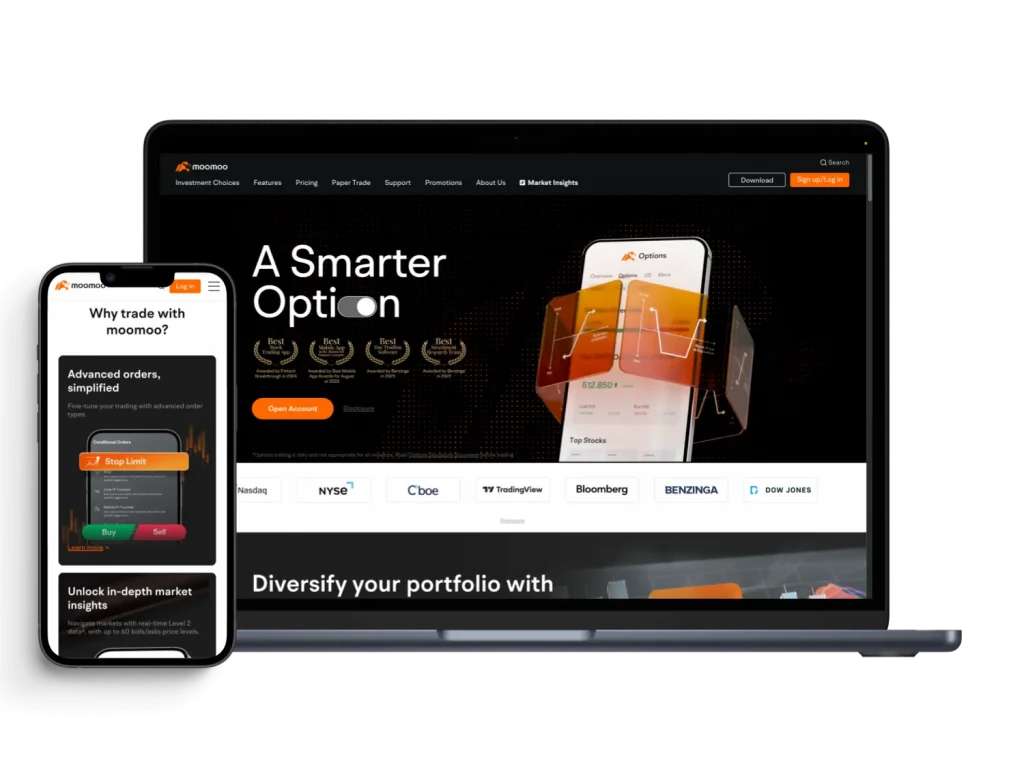

Mobile App and Web Platform

Moomoo offers an intuitive mobile app for iOS and Android devices, as well as a powerful web-based platform for desktop trading. Key features include:

- Advanced charting with over 100 technical indicators

- 38 drawing tools including trendlines, Fibonacci, Elliott Wave and more

- Customizable stock/ETF/options screeners and scanner

- Real-time streaming news feeds from Bloomberg, Reuters, CNBC and more

- Interactive global trader community to discuss ideas

- Built-in courses and webinars covering investing basics to advanced strategies

- Fully synced experience and watchlists across mobile and web

- Desktop platform supports multi-monitor layout and advanced order types

Requirements to open account:

- Be at least 18 years old

- Be a Malaysian resident with valid local address

- Provide ID (IC for citizens, passport for foreigners)

- Provide tax info, employment details, financial status

Funding and Withdrawal Methods

Moomoo Malaysia supports multiple funding methods to get started:

- FPX Online Bank Transfer (recommended for speed)

- Bank Wire Transfer

- Multi-currency Global Transfer via Wise.com or similar

- Instant Deposit (temporary limit using debit/credit card)

Withdrawals can be made easily by entering desired amount and bank details via the app or website. First-time bank account verification is required.

Accepted Funding Sources:

- Local Malaysian bank accounts

- International wire transfers

- Debit/credit cards (for Instant Deposit only)

Account Opening and Identity Verification

Opening an account with Moomoo Malaysia is designed to be straightforward:

- Download the mobile app or visit the website

- Select “Open Account”

- Enter personal details (name, DOB, address) and financial information

- Verify your identity by:

- For Malaysian citizens: Upload scan of IC (front and back)

- For foreigners: Upload passport scan and proof of address

- Provide employment status, income, trading objectives

- Read and agree to the terms and conditions

- Complete face verification through the app

Account approval typically takes 1-3 business days after submission. Any additional documents needed will be requested via email and app notification.

Education and Research

In addition to trading capabilities, Moomoo provides a wealth of educational and research resources:

- Built-in courses: Over 2,000 video lessons covering stocks, options, technical analysis and more

- Webinars: Live interactive sessions with financial experts

- Research: Professional stock reports from third-party analysts

- Market Insights: News analysis, earnings calendars, statistical data

- Paper Trading: Practice trading risk-free with $1 million in virtual funds

Real User Reviews

“I’ve been using Moomoo for a few months now and I’m very satisfied with the platform. The account opening went smoothly, and the fees are much lower than my previous broker. I especially like the charting capabilities and the news feed.” – Ahmad, 34 years old

“As a beginner investor, Moomoo’s mobile app has been really helpful. Lots of educational content and a community where I can ask questions to more experienced traders.” – Lily, 27 years old

“Overall a good broker, but the mobile app sometimes lacks stability. And the web version is still lagging in terms of features. But I like having access to global markets from one account.” – David, 41 years old

FAQ

Yes, Moomoo supports fractional share trading for U.S. stocks. The minimum purchase is just $5.

To open an account, you must:

- Be at least 18 years old

- Be a Malaysian resident with valid local address

- Provide ID (IC for citizens, passport for foreigners)

- Provide tax info, employment details, and financial status

Yes, investors can apply for a margin account with Moomoo Malaysia. The competitive margin interest rate is 6.8% per annum.